No one can deny that the use of agency workers is part of the fabric of employment in the UK. The current figure is 865,000 agency workers and this is expected to rise to 1 million by 2020 according to data from an ONS Labour Force Survey.

As a business using agency workers you need to understand that when an agency worker is on assignment with you they are temporarily under the supervision or direction of the hiring organisation, that means your organisation, but they are still employed by their agency.

As a business using agency workers you need to understand that when an agency worker is on assignment with you they are temporarily under the supervision or direction of the hiring organisation, that means your organisation, but they are still employed by their agency.

We tend to use the word ‘agency’ as a catch-all term but the term ‘agency’ can apply to temporary work agencies, recruitment agencies, staffing companies and entertainment and/or modelling agencies.

As an organisation using personnel from agencies you need to understand their rights and your responsibilities to provide a good and productive working environment.

Did you know an agency worker can have one of three main types of employment status which means they have different rights? They can be an employee, a worker or self-employed.

Workers have employment rights such as paid holiday and the National Minimum Wage, but they normally have few responsibilities to the agency and can normally decline work offered to them. An agency worker who is classed as an employee is usually employed under a contract of service. They have additional rights such as getting paid if work isn’t available, but they have more obligations to the agency than people classed as workers. Such as they might have to accept work offered to them and be available for a minimum amount of hours each week.

Agency workers who are genuinely self-employed are often referred to as contractors. They don’t have any employment rights, but have even fewer commitments to the agency, such as they can send someone in their place to do the agency work.

As a business, organisation, school or college using agency workers it is prudent for you to know workers employment status with their agency and how this could impact upon you and your reason for needing agency staff.

Our head office is in Birmingham, but we have clients all over the UK who rely on us for help and advice on all matters related to Payroll and HR please get in touch.

Following the death of a DPD driver the BBC has reported that DPD is the first parcel carrier to recognise the need to improve the way they work and offer drivers new contracts. The carrier had been under scrutiny after work pressures were blamed for the death.

Following the death of a DPD driver the BBC has reported that DPD is the first parcel carrier to recognise the need to improve the way they work and offer drivers new contracts. The carrier had been under scrutiny after work pressures were blamed for the death. The Low Incomes Tax Reform Group (LITRG) has highlighted inequalities with Auto Enrolment depending upon what type of scheme you are enrolled in and if you are low paid. Especially in light of the increase in contributions employees will be required to make from this month (April 2018).

The Low Incomes Tax Reform Group (LITRG) has highlighted inequalities with Auto Enrolment depending upon what type of scheme you are enrolled in and if you are low paid. Especially in light of the increase in contributions employees will be required to make from this month (April 2018). For employees who have opted-in to an Auto Enrolment pension they and their employers will be paying into them at higher levels from this month.

For employees who have opted-in to an Auto Enrolment pension they and their employers will be paying into them at higher levels from this month. The Employment Rights (Increase of Limits) order 2018 has been put before parliament and if approved will come into force on 6th April 2018. This order effectively sees 8 statutory provisions increase. These include the minimum amount of basic award of compensation on various aspects of unfair dismissal with the award limit in one section increasing by over £3,000 to £83,682, also the maximum amount of “a week’s pay” for the purpose of calculating a redundancy payment or unfair dismissal is increased.

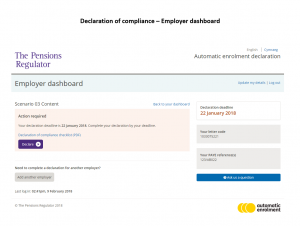

The Employment Rights (Increase of Limits) order 2018 has been put before parliament and if approved will come into force on 6th April 2018. This order effectively sees 8 statutory provisions increase. These include the minimum amount of basic award of compensation on various aspects of unfair dismissal with the award limit in one section increasing by over £3,000 to £83,682, also the maximum amount of “a week’s pay” for the purpose of calculating a redundancy payment or unfair dismissal is increased. Scheduled for around the end of March there are going to be changes to how you will provide Declarations of Compliance to The Pensions Regulator. Previously you will have used the government gateway for the authentication process. From the end of March you will use The Pensions Regulators own system.

Scheduled for around the end of March there are going to be changes to how you will provide Declarations of Compliance to The Pensions Regulator. Previously you will have used the government gateway for the authentication process. From the end of March you will use The Pensions Regulators own system. The Pensions Regulator has got their first prosecution of a firm deliberately failing to provide workplace pensions for their staff.

The Pensions Regulator has got their first prosecution of a firm deliberately failing to provide workplace pensions for their staff. During the year to 31 March 2017 HMRC received over 5,000 reports of suspected underpayments of National Minimum Wage, this is up from 2,513 the previous year. Employers need to be aware that the Government has committed £25.3m for minimum wage enforcement in 2017/18 and launched an awareness campaign for workers. If an employer is found to have been underpaying workers they face penalties of up to 200% of the arrears owed, up to £20k per worker.

During the year to 31 March 2017 HMRC received over 5,000 reports of suspected underpayments of National Minimum Wage, this is up from 2,513 the previous year. Employers need to be aware that the Government has committed £25.3m for minimum wage enforcement in 2017/18 and launched an awareness campaign for workers. If an employer is found to have been underpaying workers they face penalties of up to 200% of the arrears owed, up to £20k per worker.