Following the death of a DPD driver the BBC has reported that DPD is the first parcel carrier to recognise the need to improve the way they work and offer drivers new contracts. The carrier had been under scrutiny after work pressures were blamed for the death.

Following the death of a DPD driver the BBC has reported that DPD is the first parcel carrier to recognise the need to improve the way they work and offer drivers new contracts. The carrier had been under scrutiny after work pressures were blamed for the death.

DPD’s Chief Executive said that while their self-employed franchise scheme had benefited thousands of drivers over the past 20 years, it hadn’t moved with the times and needed updating.

DPD is reportedly offering 6,000 drivers the choice of remaining self-employed or moving to the new contract, and the company is paying for advisers to help drivers make their decision.

The Government appointed former Labour policy adviser Matthew Taylor to look at what has been termed the ‘gig economy’ and published their response to the Taylor review on Modern Working Practices in February 2018. Key among the response was “For the first time, the government will be accountable for good quality work as well as quantity of jobs – a key ambition of the UK’s Industrial Strategy.”

For advice on sick pay, holiday pay and all matters related to Payroll please get in touch and one of our helpful advisers at All Payrolls Birmingham Head Office will be only too pleased to help you.

The Low Incomes Tax Reform Group (LITRG) has highlighted inequalities with Auto Enrolment depending upon what type of scheme you are enrolled in and if you are low paid. Especially in light of the increase in contributions employees will be required to make from this month (April 2018).

The Low Incomes Tax Reform Group (LITRG) has highlighted inequalities with Auto Enrolment depending upon what type of scheme you are enrolled in and if you are low paid. Especially in light of the increase in contributions employees will be required to make from this month (April 2018). For employees who have opted-in to an Auto Enrolment pension they and their employers will be paying into them at higher levels from this month.

For employees who have opted-in to an Auto Enrolment pension they and their employers will be paying into them at higher levels from this month. The Employment Rights (Increase of Limits) order 2018 has been put before parliament and if approved will come into force on 6th April 2018. This order effectively sees 8 statutory provisions increase. These include the minimum amount of basic award of compensation on various aspects of unfair dismissal with the award limit in one section increasing by over £3,000 to £83,682, also the maximum amount of “a week’s pay” for the purpose of calculating a redundancy payment or unfair dismissal is increased.

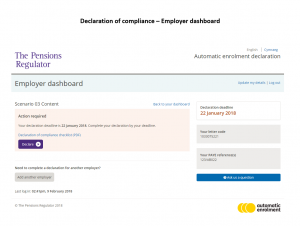

The Employment Rights (Increase of Limits) order 2018 has been put before parliament and if approved will come into force on 6th April 2018. This order effectively sees 8 statutory provisions increase. These include the minimum amount of basic award of compensation on various aspects of unfair dismissal with the award limit in one section increasing by over £3,000 to £83,682, also the maximum amount of “a week’s pay” for the purpose of calculating a redundancy payment or unfair dismissal is increased. Scheduled for around the end of March there are going to be changes to how you will provide Declarations of Compliance to The Pensions Regulator. Previously you will have used the government gateway for the authentication process. From the end of March you will use The Pensions Regulators own system.

Scheduled for around the end of March there are going to be changes to how you will provide Declarations of Compliance to The Pensions Regulator. Previously you will have used the government gateway for the authentication process. From the end of March you will use The Pensions Regulators own system. The Pensions Regulator has got their first prosecution of a firm deliberately failing to provide workplace pensions for their staff.

The Pensions Regulator has got their first prosecution of a firm deliberately failing to provide workplace pensions for their staff. During the year to 31 March 2017 HMRC received over 5,000 reports of suspected underpayments of National Minimum Wage, this is up from 2,513 the previous year. Employers need to be aware that the Government has committed £25.3m for minimum wage enforcement in 2017/18 and launched an awareness campaign for workers. If an employer is found to have been underpaying workers they face penalties of up to 200% of the arrears owed, up to £20k per worker.

During the year to 31 March 2017 HMRC received over 5,000 reports of suspected underpayments of National Minimum Wage, this is up from 2,513 the previous year. Employers need to be aware that the Government has committed £25.3m for minimum wage enforcement in 2017/18 and launched an awareness campaign for workers. If an employer is found to have been underpaying workers they face penalties of up to 200% of the arrears owed, up to £20k per worker.