The Share The Joy campaign has been launched to promote awareness of the workplace right to shared parental leave. Eligible parents can share up to 50 weeks of leave and 37 weeks of pay after having a baby. Time can be taken individually or parents can be at home together for up to 6 months.

According to the Department for Business, Energy & Industrial Strategy (BEIS) around 285,000 couples are eligible for shared parental leave each year, but most people are unaware of this and they estimate that the take up could be as low as 2%.

To find out more about Shared Parental Leave visit the government’s new website https://sharedparentalleave.campaign.gov.uk/. This website contains information for employers as well as parents. The campaign is part of the government’s commitment to not only protecting employment rights but to build on workers’ rights.

For help and advice on all aspects of payroll and HR, including shared parental leave, contact one of our experienced team at All Payrolls.

The Employment Rights (Increase of Limits) order 2018 has been put before parliament and if approved will come into force on 6th April 2018. This order effectively sees 8 statutory provisions increase. These include the minimum amount of basic award of compensation on various aspects of unfair dismissal with the award limit in one section increasing by over £3,000 to £83,682, also the maximum amount of “a week’s pay” for the purpose of calculating a redundancy payment or unfair dismissal is increased.

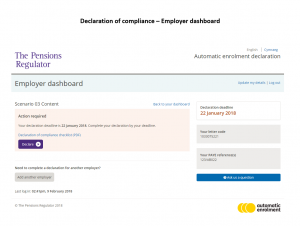

The Employment Rights (Increase of Limits) order 2018 has been put before parliament and if approved will come into force on 6th April 2018. This order effectively sees 8 statutory provisions increase. These include the minimum amount of basic award of compensation on various aspects of unfair dismissal with the award limit in one section increasing by over £3,000 to £83,682, also the maximum amount of “a week’s pay” for the purpose of calculating a redundancy payment or unfair dismissal is increased. Scheduled for around the end of March there are going to be changes to how you will provide Declarations of Compliance to The Pensions Regulator. Previously you will have used the government gateway for the authentication process. From the end of March you will use The Pensions Regulators own system.

Scheduled for around the end of March there are going to be changes to how you will provide Declarations of Compliance to The Pensions Regulator. Previously you will have used the government gateway for the authentication process. From the end of March you will use The Pensions Regulators own system. There are new rates of pay for national minimum wage coming into force on 1st April. These new rates are applicable from 1 April 2018 to 31st March 2019. In any given pay period a worker’s pay must not fall below the National Minimum Wage rate.

There are new rates of pay for national minimum wage coming into force on 1st April. These new rates are applicable from 1 April 2018 to 31st March 2019. In any given pay period a worker’s pay must not fall below the National Minimum Wage rate.